Traduction Google de la conclusion de l’article

Une chose est sûre, avec une flotte existante de plus de 11 000 véhicules récréatifs volants à prendre en charge et des milliers de véhicules récréatifs en cours de finition qui prend en charge la vente de nouveaux moteurs, d’avioniques et de centaines de pièces accessoires différentes, ce qui suivra dans les prochaines semaines et mois est tout aussi critique pour Van’s que pour l’ensemble de l’industrie de l’aviation légère.

Source: Flyer

NEWS EXTRA

How did Van’s Aircraft get into this mess?

The perfect storm that caused a cash drought at the world’s most successful kit aircraft maker

By Ed Hicks

31 October 2023

Van’s Aircraft, the world leader in producing in kit aircraft with over 50 years of experience in the industry, announced on 27 October that it was facing “serious cash flow issues, which must be addressed quickly to ensure ongoing operations.” There’s no question things were serious – the message was delivered personally by company president Dick VanGrunsven.

So how did a company with such a successful range of products and enormous order book end up here? Well there were a few factors…

Van’s orders grew significantly

When the Covid pandemic took hold of 2020, builders hunkered down with their projects. In early 2021 Van’s reported that January, February and March had been, “by a significant margin – the largest months of kit sales in the history of Van’s Aircraft.” By mid-2021 Van’s were reporting that orders for RV kits had increased nearly 250% over the preceding 24 months as new builders took advantage of the latest kit technology.

But there was a problem. A quality issue with Quick Build (QB) kits came to light. Van’s became aware that its QB kit assembler in the Philippines had made a change to the metal primer it used on components, and that change was causing corrosion problems in a large number of QB kits prepared for customers. Some of those had already been dispatched from Van’s to customers.

Van’s replaced kits that could not be easily fixed, or offered substantial discounts on those that builders felt they could rectify, but overall many were a total loss due to the labour that would be required to dismantle and replace the parts involved.

Incoming QB inventory was leveraged to help fill the demand for replacement kits for affected customers, but that only served to delay orders for the customers who were behind them in the queue. A ramp-up in production was needed, but punching parts on the Trumpf punch presses employed by Van’s could only go so fast, even with running the machines 24 hours a day.

A switch to laser cut parts

In early 2022, following evaluation of the manufacturing process and extensive fatigue testing of materials, Van’s began manufacturing some parts via partner contractors utilising a fiber laser cutting process. The process yielded fine cuts with precision quality at speeds far faster than punching parts.

At the same time there was a shipping cost problem brewing. Quick Builds depend on shipping to and from the assembler, and the cost of containers in post-Covid times had sky-rocketed. Originally shipping the parts to the QB assembly centre and returning the part-built airframes to Van’s had cost $500 per kit. The cost was now more than $2,500 per kit.

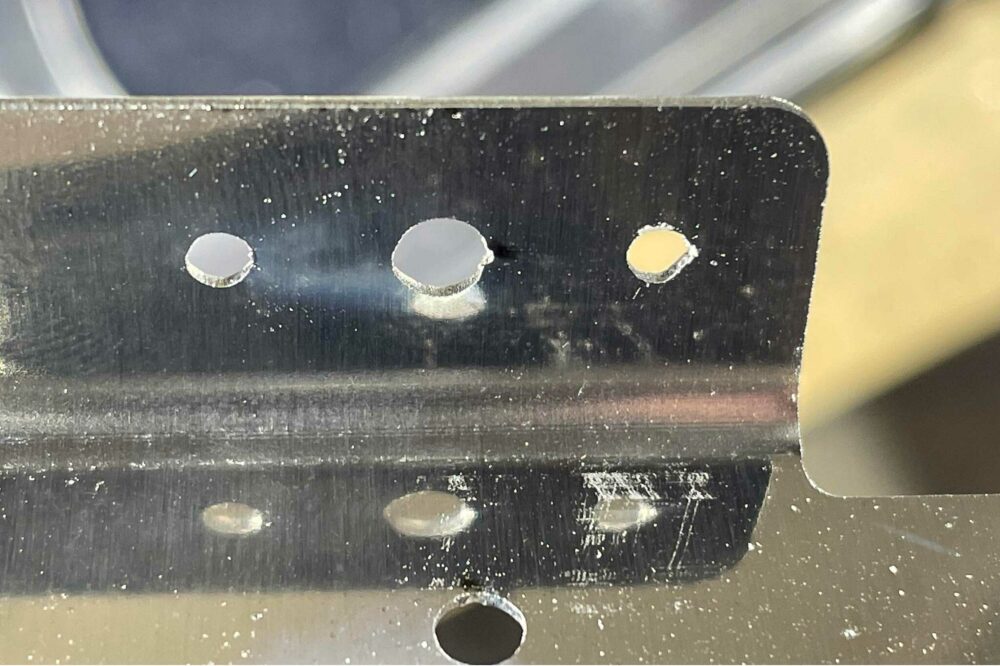

Then Van’s began to receive reports from builders that cracks had formed in some parts with laser cut holes while dimpling, or while riveting the dimpled holes. Van’s reacted by encouraging builders to pause building kits that included laser cut empennage/tail, aileron and flap spar parts, while they investigated the problem.

The investigation was extremely thorough. Hot spots on hole edges in parts manufactured by one of the laser cutting vendors were identified as the culprit for the cracking. While Van’s had provided specific cutting paths for every part to avoid problems, the vendor had reprogrammed their own tooling paths.

Video: Watch Van’s describe what went wrong with laser cutting, in this presentation at Oshkosh 2023

Size of the laser cut parts problem

While the laser cut part investigations were slow, the builder chatter on internet forums and social media was fast. Orders slowed down, inventory built up…

Just how bad is the laser cut parts problem? Van’s estimates it affects around 1,800 customers, some of whom have received more than one kit containing some parts that were laser cut.

Impacts vary from customer to customer, with one customer declaring in an online forum they only had $15 worth of parts that needed to be replaced, while another said they had $4,500 worth of standard kit parts, of which $1,800 had been identified by Van’s as ‘replacement required’.

Having done extensive testing, which Van’s had independently verified by a third-party testing company, the parts that were classified as ‘Replacement Recommended’ were those that were “somewhat susceptible to fatigue damage over the life of the aircraft, but pose no immediate risk to the safety of flight.”

In the report delivered to customers, Van’s noted “The most conservative analysis, with statistical life reductions and evaluated at the highest-loaded rivets under near constant aerobatic conditions still predict that these parts have lives measured in thousands of hours.” But for many customers, it still wasn’t enough.

The spiral was insane – Van’s not only found themselves in a situation of having to deliver kits that were sold two years ago at pre-inflation prices (and that they were also facing the inflated-price of raw materials), but they were millions of dollars into the cost of fixing the QB primer issues and the laser-cut part problems. Prices had been going up, but nowhere near enough.

A path to recovery?

One thing that seems likely is that Van’s products will prevail. The trail of successful kitplane manufacturers that have been face to face with bankruptcy includes Europa Aircraft, SkyStar Aircraft who made the Kitfox, and Stoddard-Hamilton Aircraft who produced the Glasair and Glastar.

The Stoddard-Hamilton story may sound familiar here. Famous for the world’s first pre-moulded composite kit aircraft, over time their kits became increasingly popular and easy to assemble and fly. By 2000, however, the company’s low profit margins finally led to bankruptcy.

After buying the firm’s assets and forming Glasair Aviation LLC in 2001 to continue production of Glasair and GlaStar kits, new owner Tom Wathen hired Mikael Via as its president and chief operating officer.

Via is credited with the successful turnaround of Glasair Aviation, including creating the ‘Two Weeks to Taxi’ programme. Customers spent two weeks with their kit at the factory creating an almost complete aircraft they could take away and apply the finishing touches to at home. In 2011 when Wathen, then 82, decided it was time to sell Glasair, Via guided the sale of the company to the Jilin Hanxing Group and retired.

Now Mikael Via has been named as the new Van’s Aircraft interim CEO – that could be seen as good news. He’ll work with experienced advisors from Hamstreet & Associates, a Portland, Oregon-based firm that specialises in provide financial expertise, to help Van’s move forward.

One thing is for sure, with an existing fleet of over 11,000 flying RVs to support, and thousands of RVs in a finishing pipeline that supports the sale of new engines, avionics and hundreds of different accessory parts, what follows in the next few weeks and months is equally as critical for Van’s as it is for the wider light aviation industry